The pros and cons of selling lens care solution

Historically, we know that competing with big box stores for profit is an uphill battle-like trying to fight the Ebola virus with a Z-pack.

For years, contact lens solutions have been available to sell in office, but relatively few of us have pursued that stream of revenue. Perhaps because it’s more of a dried-up creek? But recently, there’s been a heightened buzz around the topic, so maybe it’s time to consider the pros and cons once more.

Historically, we know that competing with big box stores for profit is an uphill battle-like trying to fight the Ebola virus with a Z-pack. When you include the potential capital outlay for the bottles, as well as the space requirements for their storage and display, the aggravations start to add up.

But with some of the new programs, these previous objections are neutralized. A more difficult debate to defuse is whether or not having retail bottles in the office creates a pressure-and potential discomfort-on the staff to sell.

We don’t want to exhaust their sales energy on a low-profit item or divert their efforts from some other high-benefit product we sell. And could it create a perception that we are greedy, nickel and diming the patient?

Related: 5 ways to improve in-office purchasing

Increasing patients’ perception of value

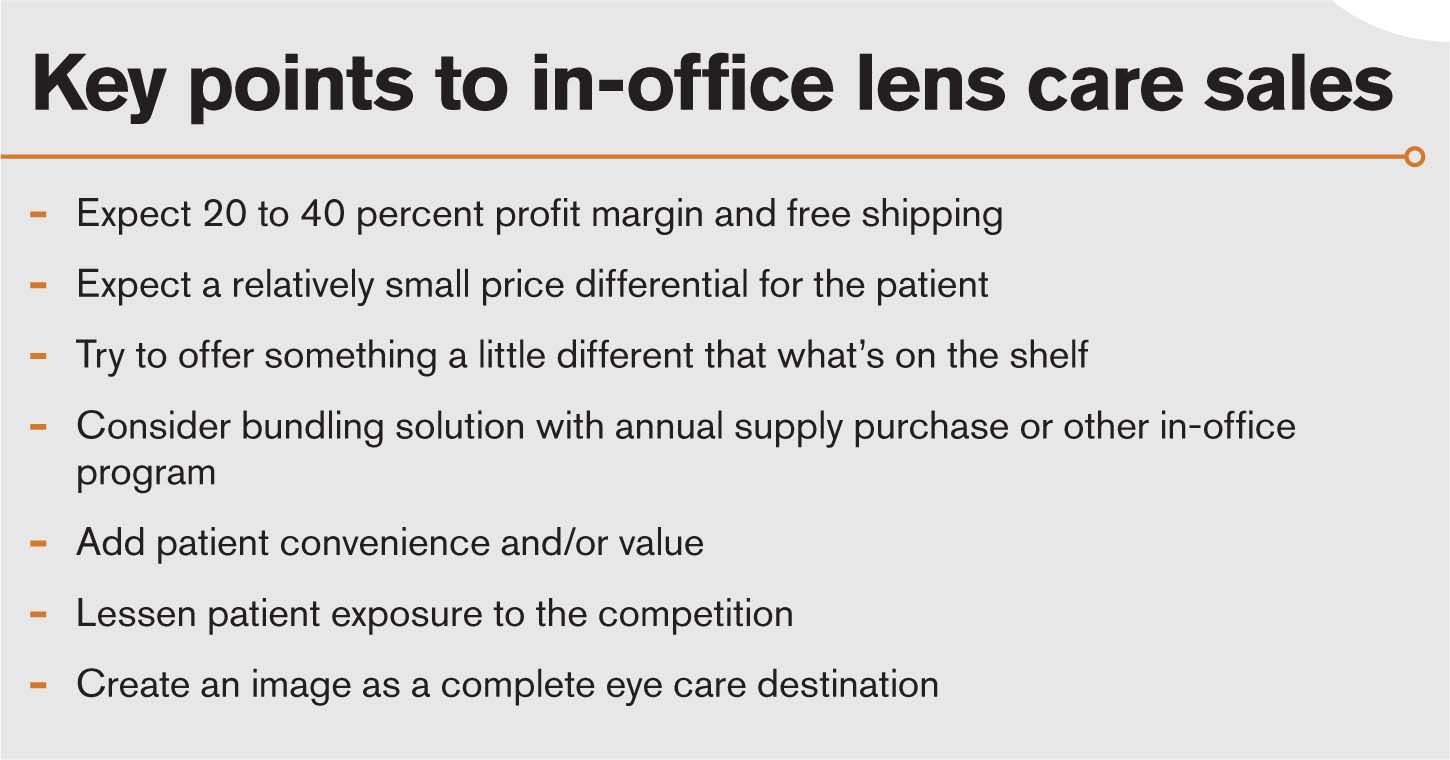

What if we remove the question of profit and competition from the equation? Some offices give it away for free, as an added value, with the purchase of an annual supply or color lens add-on.

Others include it as a benefit offered in their contact lens maintenance program. Some doctors sell the solution, but charge even less than other retailers, hoping to build trust and credibility with the patient.

Any of these options increase the patient’s perception of value. No matter how you choose to distribute it, having solution in the office allows you to provide for all of their eyecare needs. Even if they choose to purchase elsewhere, they realize that you are striving to offer them complete eye care and convenience. And, ultimately, you have their best interests in mind.

Next: Offer something different

Offer something different

What we want to avoid is the perception that we are selling solution out of greed, simply to acquire every eyecare dime the patient spends. We can escape that perception if we are purposeful.

First, don’t charge significantly more than what other retailers charge.

Second, offer something different than the other retailers whenever possible.

For example, Alcon’s Pro line allows you to sell bottles with more ounces than typically found on the shelf. This adds value to the patient’s purchase, avoids a direct price per bottle comparison, and allows you to charge the same price per ounce relative to the every day prices in a big box store. Or if you carry another brand, you might consider throwing in a complimentary travel size bottle with the purchase.

Another example is the Sauflon model, in which solutions were offered for sale only within the doctor’s office. Since CooperVision’s recent acquisition of Sauflon, there has been no public announcement about continuation or development of the previous in-office program.

A third, more drastic way to convince patients of your genuine intentions is to donate the proceeds of the solution sales to a national eye charity or possibly a local community cause. After all, the profits are negligible-or are they?

Related: Prevent dropout by asking the right questions

The profit margins

Bausch + Lomb recently partnered with Vision Source to offer an in-office program. Alcon recently released a full-blown business strategy around in-office solution sales. CooperVision is currently maintaining the availability of Sauflon solution.

AMO continues to make its solutions available to the doctor. Depending on the company, you can expect to see a profit margin of 20 to 40 percent per bottle.

Using Alcon’s new program as an example, the difference between the unit cost and manufacturer’s suggested retail price (MSRP) is about 30 percent. But if you qualify for end-of-year quantity rebates, it can boost your profit up to 40 percent.

Meanwhile, the patient is paying the same relative price per ounce as an every day price at a big box retailer, and less than a typical grocery store. Of course, retailers often have sales or rollbacks and may use solution as a “loss leader” to get consumers’ attention, decreasing the price per ounce.

Next: Increase compliance and remain competitive

Increase compliance and remain competitive

Whether it’s a corporate strategy or not, there are great benefits to having access to solutions from all four companies. You won’t be limited to a specific brand just because you wish to provide solution to your patients in office.

We know the need for patient direction and the power of the recommendation. Now you can sell what you would typically recommend, thereby ensuring compliance with your recommendation. And compliance may lead to a positive effect on the patient’s contact lens comfort and wearing success.

Furthermore, it reduces the potential of the patient being exposed to a competitor while buying solution-a company that also sells contacts and offers eye exams. It keeps them from associating another store with eye care!

The goal is to maximize convenience to the patient without minimizing our own. Luckily, corporations are catching on.

Currently, there is only one company that allows you to order solution straight from your contact lens distributor, as needed. But regardless of where you get it, there is now no reason to keep large amounts of solution on hand. You get the same price, buying it one case at a time-or even one bottle at a time, in some cases.

And there are no shipping costs to the doctor with any of the four companies. Some brands will ship bottles directly to the patient, even free of charge with a minimum purchase. This opens up the option to sell solution on your website, if desired. Remember, it’s about convenience and perception, not sales.

Keep in mind: you are not likely to change the habits of those who buy their solution at club stores. So, don't try! That's not the goal. The goal is to create a patient perception that you have gone out of your way for their convenience, and there is no need to go elsewhere for their eyecare needs.

While a profit margin of 20 to 40 percent pales in comparison to the profit margin of a frame, it keeps patients in the office and adds value. This is a moment where the focus must be on the big picture.

Click here to read the latest news and advice on contact lenses

Newsletter

Want more insights like this? Subscribe to Optometry Times and get clinical pearls and practice tips delivered straight to your inbox.