Survey investigates eye care provider preferences for geographic atrophy treatments

A study surveying retina specialists found surprising results in therapy preference.

(Image credit: Adobe Stock / boyhey)

Geographic atrophy (GA) typically occurs late in life, with onset taking place after age 60. It has been determined that those of European descent, those with a family history of age-related macular degeneration (AMD), and current and former smokers have a higher risk of developing GA. Furthermore, having light-colored eyes as well as having eyesight of 20/200 or worse are also risk factors for developing GA.

A recent study conducted by REACH Market Research surveyed ophthalmologists specializing in GA.1 The survey looked at 25 ophthalmologists in the United States with more than 75% of time devoted to direct patient care, a minimum of 3 years’ and no more than 30 years’ experience, and a minimum of 25 GA patients currently under their care.

Pegcetacoplan (Syfovre; Apellis) and avacincaptad pegol (Izervay; Iveric Bio) are the only FDA-approved treatments for GA secondary to AMD. Syfovre was approved in February 2023, and Izervay was approved in August 2023.

Before the approval of pegcetacoplan, physicians had no treatment options besides convincing patients to enroll in clinical trials or monitoring patients’ lifestyles. Most patients with intermediate AMD are on dietary supplements known as AREDS 2, which have some ability to slow down AMD progression. Surveyed ophthalmologists estimated that over 80% of their patients with AMD are on AREDS 2 currently. Months after the drug’s approval and launch, physicians estimate that approximately 10% of their patients are on pegcetacoplan.

Interviewed physicians also stated that there is “a lot to be desired” in terms of pegcetacoplan’s efficacy. Key opinion leaders (KOLs) highlighted the ability of the drug to slow down lesion growth rate but reported concerns regarding the lack of functional benefit related to vision improvement and vision-related quality of life (QoL) improvements.

Furthermore, only 30% of surveyed physicians rated their experience with pegcetacoplan’s efficacy and adverse effect profile as “very impressive.” Based on the fact the drug takes 24 months to provide clinically meaningful functional benefit, surveyed physicians said they do not see a point in prescribing pegcetacoplan to older patients (>95 years old) and are skeptical about its effectiveness in patients who have lesions in the foveal center.

Based on KOL feedback, ideal candidates for pegcetacoplan include the following:

- Patients who meet the Classification of Atrophy Meetings optical coherence tomography definition of complete retinal pigment epithelium and outer retinal atrophy and

- Are losing central vision in one eye because of GA and have extrafoveal lesions in the other eye, or

- Are getting treated for wet AMD in one eye and have dry AMD in the other, or

- Patients with very small lesions far from the fovea.

Sixty percent of the surveyed physicians have previously prescribed pegcetacoplan in the clinical setting. Of those, 35% listed the drug’s ability to improve vision-related QoL outcomes as unimpressive, with 30% also listing the insurance coverage and access as an issue. Patients with commercial insurance and Medicare patients without supplemental plans may face high out-of-pocket (OoP) costs.

Pegcetacoplan costs $2,190 per injection. With dosage frequency being monthly or every other month, patients can expect to pay between $13,140 and $26,280 per year for pegcetacoplan treatment.

Since GA patients are typically over the age of 60, many rely on Medicare, according to surveyed ophthalmologists. While Medicare covers 80% of the cost of pegcetacoplan, surveyed ophthalmologists estimate that only about one-third of their patients have Medicare plans that include supplemental insurance to cover the remaining OoP costs. Furthermore, those ophthalmologists estimate more than 40% of GA patients for whom they have prescribed pegcetacoplan have difficulty staying on it because of insurance restrictions and/or high OoP costs. According to Apellis, up to 90% of pegcetacoplan patients rely on Medicare coverage and may pay a minimum of $219 per month before supplemental coverage.

On top of this, the biggest barriers to pegcetacoplan treatment, according to the interviewed doctors, include patients’ lack of awareness about GA, fear of eye injections, and concerns about adverse events.

Also, because GA is a disease that primarily occurs in elderly patients, intravitreal injections every 25 to 60 days can be a challenge, especially for those whose ability to drive is already impaired by the condition.

When asked why they are not prescribing pegcetacoplan, half of nonprescribers stated they are waiting for additional functional data and have concerns about safety. A quarter listed unimpressive efficacy data as well as significant reimbursement challenges with insurance as hurdles.

Looking ahead

In the future, therapies can distinguish themselves from pegcetacoplan by further improving upon its efficacy while demonstrating an earlier functional benefit. Since it only slows down and does not stop GA, there is a high need for cell- and gene-based therapies that can potentially halt progression. These one-and-done treatments may be the future of GA treatment.

Industry leaders stated there is a great unmet need for treatments that prevent blindness and improve vision, but they acknowledge that such goals are difficult to achieve now. Over 70% of those surveyed listed improving vision and preventing vision loss as extremely important unmet needs in GA treatment.

Currently, there are various therapies in phase 2 and phase 3 clinical development for the treatment of GA. According to the interviewed KOLs, however, no one therapy stands above the rest as particularly promising.

Alkeus Pharmaceuticals and Belite Bio both have orally administered drugs in development. Alkeus’ ALK-001 is in a phase 2 multicenter, double-masked, randomized, placebo-controlled study, while Belite Bio’s LBS-008 is in a phase 3, multicenter, randomized, double-masked, placebo-controlled study. Additionally, ONL Therapeutics, Novartis, Genentech, and Astellas are among the other companies with GA therapies in their pipeline.

Surveyed ophthalmologists anticipated prescribing pegcetacoplan to 39% of their GA patients and avacincaptad pegol to 22% of their patients prior to its approval.

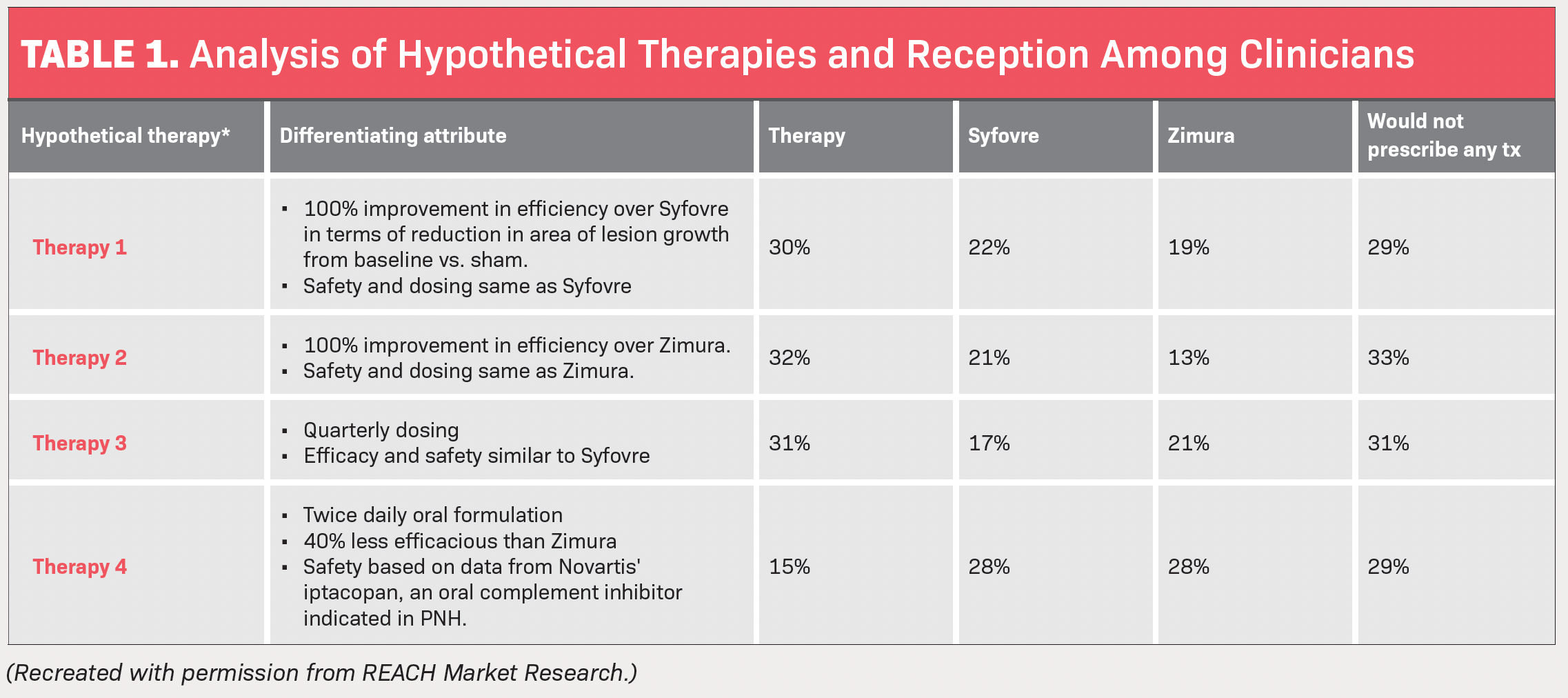

The study by REACH also investigated what type of hypothetical therapy patients would benefit from the most and which therapy the ophthalmologists surveyed would be most likely to prescribe vs pegcetacoplan and avacincaptad pegol. The hypotheticals consisted of 4 different therapy treatments with different characteristics.

- Therapy No. 1 has a 100% improvement in efficacy over pegcetacoplan in terms of reduction in area of lesion growth from baseline vs sham and has the same safety dosing. Thirty percent said they would prescribe this over pegcetacoplan and avacincaptad pegol, while 29% said GA patients they treat are unsuitable candidates for any of the 3 therapies.

- Therapy No. 2 has a 100% improvement in efficacy over avacincaptad pegol, with safety and dosing the same. Thirty-two percent of the surveyed physicians said they would prescribe this over pegcetacoplan and avacincaptad pegol, while 33% said GA patients they treat are unsuitable candidates for any of the 3 therapies.

- Therapy No. 3 consists of quarterly dosing, with efficacy and safety similar to pegcetacoplan’s. Thirty-one percent of the surveyed physicians said they would prescribe this over pegcetacoplan and avacincaptad pegol, with the same percentage saying GA patients they treat are unsuitable candidates for any of the 3 therapies.

- Therapy No. 4 is a twice-daily oral formulation and is 40% less effective than avacincaptad pegol, with safety based on data from Novartis’ iptacopan. For this, only 15% of physicians said they would prescribe this over pegcetacoplan and avacincaptad pegol, while 29% still said GA patients they treat are unsuitable candidates for any of the 3 therapies (Table).

Based on this info, REACH concluded that a therapy with significant improvement in efficacy over pegcetacoplan or avacincaptad pegol but with similar safety and dosing frequency could be favored by more than 30% of physicians.