Top 5 ways you break the law in your practice

One of the first lessons doctors learn once they actually get into practice is that we are all in business. The business aspect of optometric practice is comprised of multiple layers and elements that are challenging at best.

One of the first lessons doctors learn once they actually get into practice is that we are all in business. The business aspect of optometric practice is comprised of multiple layers and elements that are challenging at best. New laws and regulations occur annually and oftentimes more frequently. They may be federal, state, or local laws and ordinances or labor laws encompassing minimum wage, overtime, working conditions, etc.

In addition, they may be profession specific, originating from state board regulation changes or legislative enactments. Sometimes, it can be difficult separating the business side from our professional side because they often intertwine.

Noncompliance with any of these laws or regulations may be simple ignorance, a matter of seeing just how close you can come to the edge of the legal system without going over, or an outright and knowing violation of existing or new changes. In the latter instance, there is the hope that we won’t get caught-or if we do, we can plea bargain or argue our way out of the consequences.

More practice management: Recovering from a fire in the optometry practice

Simple ignorance, while no excuse in the eyes of the law, does occur. We all make mistakes, and we all are ignorant of new changes in laws and regulations. Typically, these transgressions are minor and easily corrected, once they are discovered.

Continued disregard, once we are aware of the problem, can lead to significant and highly detrimental consequences. Those include sanctions by your state board; publication of those sanctions, fines, probationary status, etc.; postings of said sanctions on the state board website for consumers and your patients to view, and more.

Of course, prosecution by the state board or other appropriate law enforcement personnel can also occur. The end result will be unpleasant in the least and can be extraordinarily detrimental to your reputation, your psyche, wallet, patient goodwill, staff morale, and marketability of your practice.

There are several areas in which doctors tend to go astray, sometimes with total disregard of the ultimate outcome. But most instances are mistakes made in the innocent day-to-day decisions we experience in running our practices where we just don't think until it becomes a serious and often destructive force.

With this in mind, let's explore several of those treacherous areas that pose a potential risk. Here are the top five.

Next: Theft

1. Theft

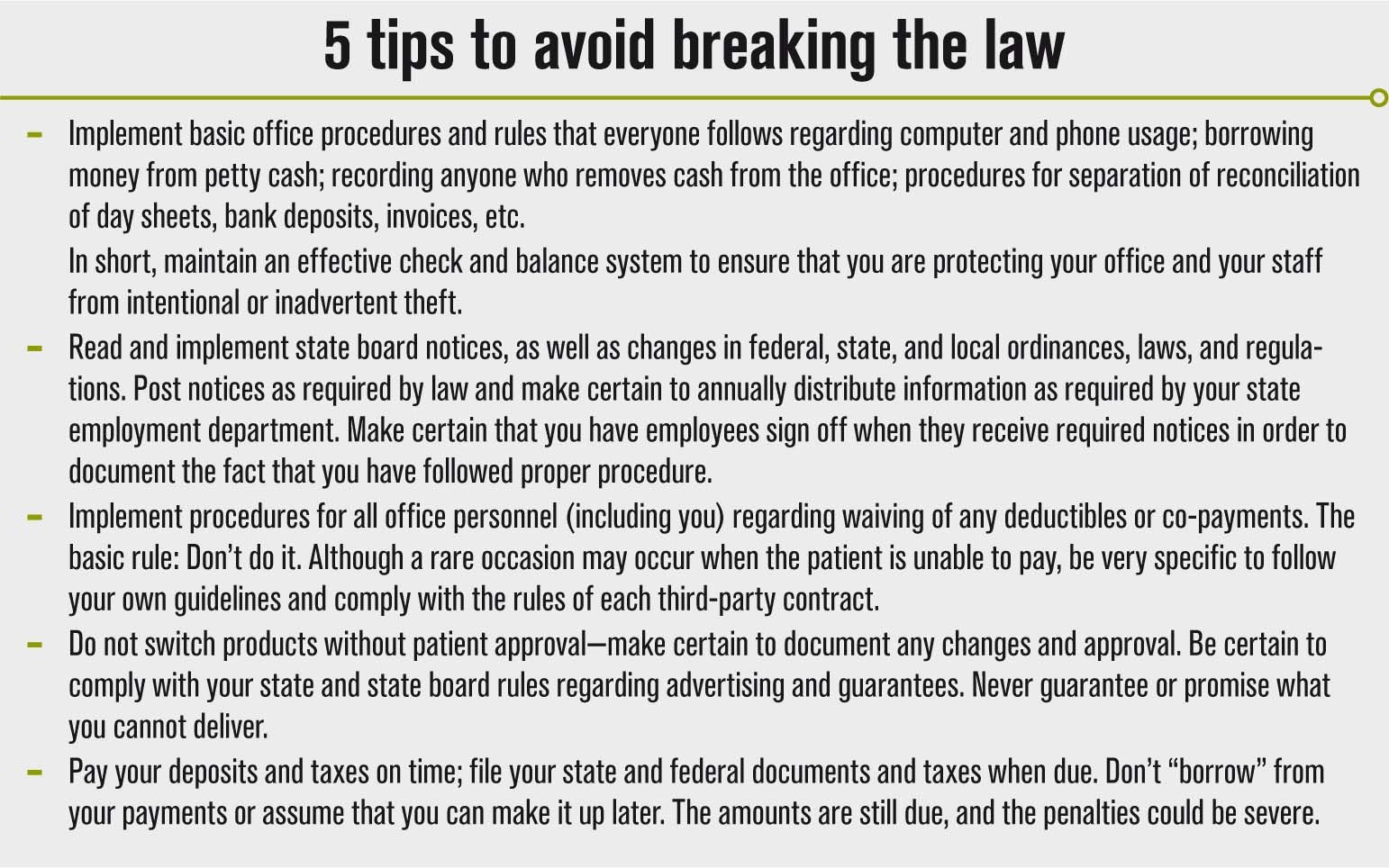

Stealing is not uncommon in our practices. We are all conscious of the potential for employee theft, and the wise doctor takes precautions. Make certain that no single employee handles all transactions and finances, payments, bills, bank deposits, reconciliation of invoices and day sheets, and ordering.

Some of us forget about the other side of theft: the doctor side. While it may be your office, it is important to establish firm rules. If you take cash from the office without signing for it, it encourages your staff to do the same, sometimes with the intent of repaying it, but oftentimes knowing that it won't be missed.

This may create some trust challenges, but it should be handled in your office policy manual.

When cash is removed from the daybook or wherever patient payments are maintained, make certain that it is sign off by whomever removes it.

This means that if you take the cash from the office, you need to sign for it. If the money is transferred to petty cash for change, used for stamp purchases, or purchasing an office lunch, whomever removes it must sign for it and list the reason for removal.

More practice management: Fill-in ODs: Practice problem or solution?

You should periodically make certain that deposits match payment records and that day sheets are reconciled.

Although one staff person may be responsible for balancing the day sheets, a different person should make the deposits (which should be you!), and someone else should balance the invoices. You are held to the same standard as your staff (or higher) when it comes to finances.

You (or your accountant) should be the only office person writing company checks to ensure that the books balance and to minimize financial discrepancies and theft.

Sometimes the thought is that because they are our practices and we own them, we are entitled to take what we wish with no worries and no consequences. The bottom line is that we are in fact stealing from ourselves.

Technically, the stamps you take for personal use, having staff run personal errands, taking home toilet paper or pens, it all belongs to the office. If your staff sees you taking, then are they not also entitled to take without fear of discipline or retribution?

Whether it is time or materials being used for personal gain, it is actually stealing from the office and indirectly from you. Of course, it can become somewhat ridiculous, but try to look at it purely from a black and white standpoint and then make the decision about what falls within your frame of legal and ethical authority.

You do have an obligation to set an example for your staff, so make certain that you both "talk the talk" and "walk the walk"!

The bigger side of theft is the doctor who doesn't record cash payments or keeps a double set of books. Not only is this just dumb, it is a higher level of theft which could result in prosecution. Even worse, unreported income leaves the door open for the staff person who elects to report this transgression.

The staffer may end up losing her job, but she could also be the recipient of a bounty paid to her for turning you into the IRS for unreported income and underpaid taxes. True, it takes quite a while to get to this point, but in a higher volume practice, you will get there sooner and the risk is even greater.

Next: Failure to comply with state board regulations

2. Failure to comply with state board regulations

It is not uncommon for us to not read those messages sent out by the state board regarding regulation and law changes. However, we are still held accountable for what they say and the requirements they impose.

Most often, those messages include changes in continuing education requirements; consumer postings required in the office; changes in the law, which may include reporting, expansion of professional services, drug changes, advertising restrictions or requirements, branch office and fictitious name rules.

Simple failure to comply may be over-reporting CE attendance, attesting to meeting the educational requirements for re-licensure when they have not been met, failing to post consumer notices, or failing to post proper licenses as required by your state and local government.

Other areas may be even more egregious, including failing to report suspected child or elder abuse or utilizing drugs and/or alcohol that impairs your professional judgment. The resulting effect may be censure or other legal penalties or fines imposed by the state board.

The state board is entrusted with protecting the public, even when some of the rules may seem silly or just seem to have no reason for implementation or carrying out. If you feel that a regulation is not pertinent, then work to change it. Don't violate the law or regulation thinking that you will be able to effect the change you seek without legal repercussions.

Next: Waiving deductibles or copayments

3. Waiving deductibles or copayments

This is one of those tricky situations in which our empathy and emotions can get us into difficulty with the state board as well as the organization holding the vision care/medical care contract.

Typically, our contracts are very specific and do not allow for us to waive fees or substitute products that are not covered under the doctor/provider contract.

It could be construed as fraud or even may be grounds for litigation, as well as removal from the panel and possible sanctions. If a pattern of waiving fees can be shown for these patients, the consequences could be quite serious.

More practice management: What a millennial OD can bring to your practice

4. Bait and switch, guarantees

If you advertise a product or service, it is improper to switch or substitute a different product or service without giving the consumer/patient proper notification. In essence, when a product becomes unavailable, it is prudent to notify the patient so that he can make an informed decision about the alternate options.

It is always appropriate to let your patients know that you will do the best you can for them and their visual welfare. However, take caution when offering guarantees. While you may guarantee to do your best, that is different than guaranteeing that the patient will be happy, her glasses won't break, or you can fit her with contact lenses giving her optimum vision and comfort.

Just be careful when it comes to guarantees. If, for example, a manufacturer is involved and it guarantees to replace the frame if broken within a year, just be certain that you know the exact terms and convey those specifics to your patient. Otherwise the patient may mistakenly assume that the frame is guaranteed for an indefinite period.

Next: Failure to pay appropriate taxes

5. Failure to pay appropriate taxes

This is one of those areas that many doctors may experience at one time or another. State, federal, and local taxes are due when stated. When finances become a challenge for a doctor, it is easy to let the taxes due slip.

Typically, the thought is that it is only short term, the money just isn't there but will be in the future, or that things are going downhill fast and there is no way out. In short, other bills are due and immediate. State and federal tax deposits are easily put off or overlooked, particularly if paid on a monthly basis.

More practice management: 4 ways to improve vendor relationships

While there may be some leeway in terms of actual date due, depending on the size of your practice, there is no forgiving of this obligation. Failure to pay your employment taxes can result in quite serious repercussions and have long-lasting effects on your practice as well as your employees.

You not only can face serious sanctions and charges, but you could also end up in labor court. Any way you slice it, this is really a big no-no, to say nothing of the headaches it will end up causing you.

In short, we all owe it to ourselves, our patients, our employees, and our families to think before we knowingly take that first step in the wrong direction.

Should we start to meander down that road, then it is our duty and responsibility to assess the situation, consider all the viable options, and step up to remedy our error. If you are in doubt, always consult with your legal advisor and/or state board of optometry.

Newsletter

Want more insights like this? Subscribe to Optometry Times and get clinical pearls and practice tips delivered straight to your inbox.