How to calculate the value of your practice

An optometric practice is worth what someone is willing to pay. ODs must plan an exit strategy well before it’s time to move on. A practice management expert offers advice.

Many ODs want to know what their practices are worth. As private equity continues a frantic pace in practice acquisition, this question will likely be asked more often.

So, what is your practice worth?

Calculating value

No exact science or calculation exists to determine the value of your practice. Numerous factors come into consideration, such as location, facilities, existing doctors, and whether the selling OD is staying after the sale. Other factors include key staff, gross sales, net sales, existing contracts, and suppliers.

The buyer also plays a large role in practice valuation. Buyers are buying for a financial reason or a strategic reason. Typically, buyers purchasing practices for strategic reasons will offer a higher dollar amount.

Related: Why ODs need a business strategy

One of the easiest numbers to use as a benchmark is sales price as a percentage of collections. In the past 18 months, I have seen this range from 35 percent to 125 percent of a practice’s one-year gross collections.

The other number used is multiple of earnings. In this category, we see a range from 4 to 7 times earnings before interest taxes depreciation and amortization (EBITDA).

Prepare accordingly

Practices that have sold for higher percentages or multiples are well run and have a strategy to increase their value. It is important to have a plan in place before deciding to sell a practice.

Many practice owners wait until they must sell to start asking questions on how to prepare and sell their practices. Waiting this late to begin preparing to sell can lead to a bad situation and may result in a lower selling price. Everyone will exit their practices at some point-the sooner you set the exit plan and strategy, the better.

Financial performance key

The primary driver of practice valuation is financial performance. Unfortunately, this is an area that many ODs do not fully understand, and they are often disappointed in the valuations determined for their offices. Without getting into detail on EBITDA and calculations, here is a quick look at two practices with different financial performances.

Practice 1. Total collections are $1 million, and total EBITDA for the practice is $240,000. If we assume that the doctor will be paid $150,000 in salary after the sale, it leaves $90,000 in earnings. With a multiple range of 4 to 7 times of $90,000 in earnings, the practice valuation would be between $360,000 to $630,000.

Practice 2. Total collections are $1 million and the total EBITDA for the practice is $350,000. If we assume that the doctor will be paid $150,000 in salary after the sale, it leaves $200,000 in earnings. With a multiple range of 4 to 7 times the $200,000 in earnings, the practice valuation would be between $800,000 and $1,400,000.

Related: Why it’s important to have a marketing plan

As you can see, the range of possible purchase prices can be dramatically different based on the financial performance of the practice. Both examples above would typically be in the 4 to 5 times multiple range unless the buyer has a strategic need to buy the practice.

All the other factors mentioned earlier will also impact the final purchase price.

Increase your practice’s value

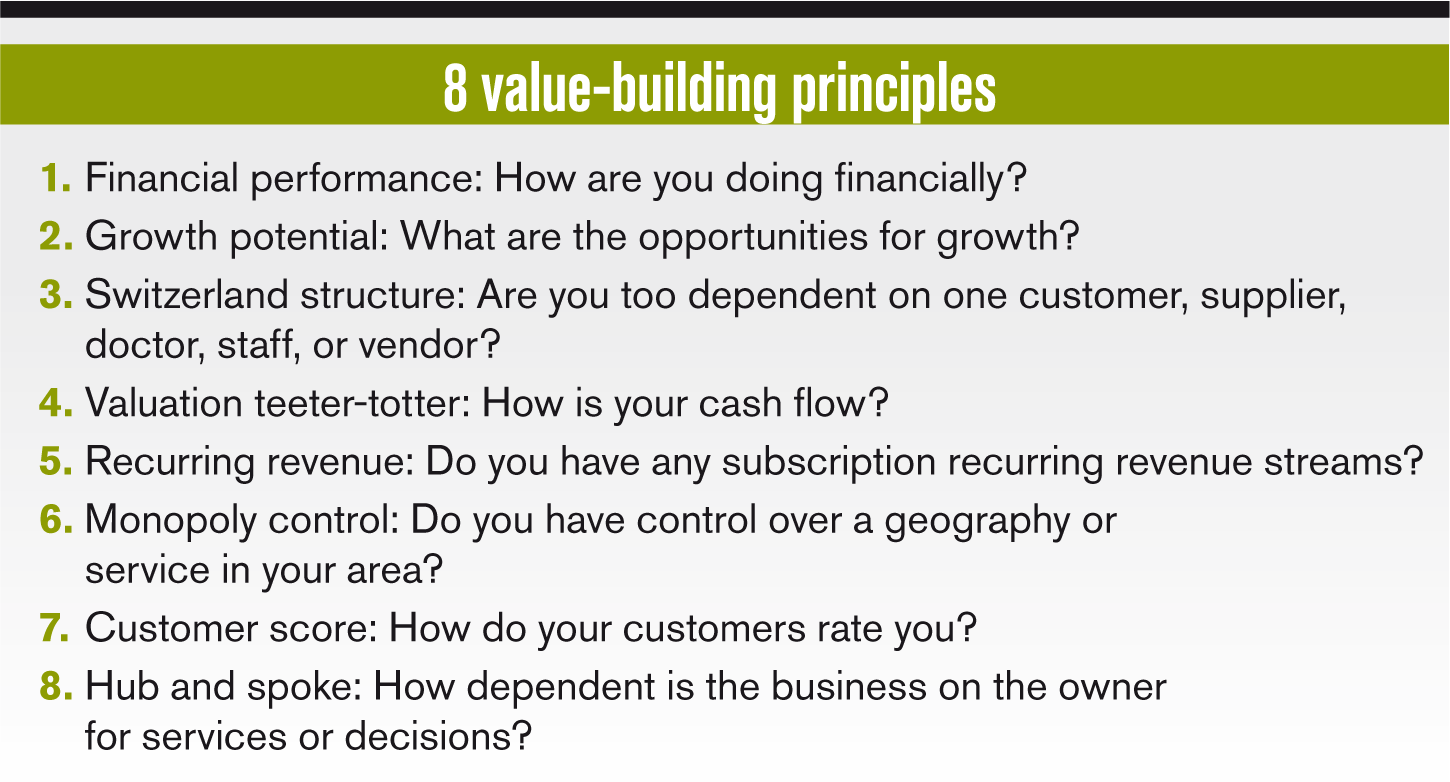

It is critical to start early to build the value of the practice by working to improve all value drivers. When I work with practices, we use a “foundation of eight” value-building principles that are areas to consider and help increase the worth of a business (See box). John Warrillow mentions these eight principles in his Value Builder System, a guide for selling any business.1

These areas of driving value are not unique to optometry but are universal across all small businesses. By focusing on areas that help drive value, you will naturally increase financial performance and enhance the other factors taken into consideration when determining the final purchase price.

Ultimately, your practice is worth what someone is willing to pay. Instead of asking, “What is my practice worth,” the question you should be asking is, “What am I doing to increase the value of my practice?”

References:

1. Warrillow J. The Value Builder System. Available at: http://valuebuildersystem.com/. Accessed 5/14/18.

Newsletter

Want more insights like this? Subscribe to Optometry Times and get clinical pearls and practice tips delivered straight to your inbox.